As a 42 year-old, quasi-adult, I have several friends who’ve been married and subsequently divorced. A recent group chat exchange commenced with one buddy sharing a wedding-day image of himself and other chat member. “I like how serious you look.” “I just knew I was about to lose half my net-worth.”

Yesterday I started to emerge from a severe bout of depression. Today I found myself compelled to inject positive spin on that conversation. Divorce was tough for that guy. I found creative means to help him when I could. It’s always easier to help other people than help myself. It’s more fulfilling. Here is what I wrote:

“We all have made mistakes in our younger years. Without daring risks, what opportunities would we have forgone?

Your net worth is probably 2x now after marriage to [your second wife]. Our cost basis for $NVDA and $SHOP is less than $10k but our positions in those two companies is more than 20% our portfolio...

We’ll be defined by our successes, not by our failures. Whether financial or otherwise, we can only lose what we chose to invest in our failures. Our successes will compound to become orders of magnitude greater than the initial cost. Successes become what defines us.”

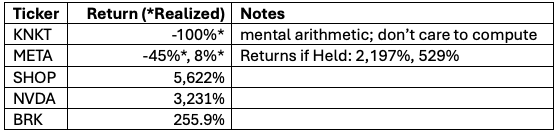

More detail about our investment returns are below:

We first bought ten shares of Facebook (now Meta, $META) for $338.63 in 2012 and summarily sold them in 2013 for $186 in 2013. Had we retained those ten shares, they’d be worth $7,780 today. We also bought 27.54 shares in 2016 for 3,338.40 and 32 shares for $5,050.84 in 2018. Had we not harvested the tax loss on these 59.54 shares in 2020, the additional $META shares would have been worth, roughly $46,300 in September 2025. Ignoring any returns on the $10,000 we salvaged from our investment in $META, the decision to liquidate our $META positions cost us a bit more than $44,000.

I lost about $1,400 due to investment in $KNKT – the subject of a pump-and-dump scheme. My, now defunct, Yahoo! email account received messages about penny stocks – $KNKT was supposed to be a manufacturer or marketer of smartphones in China. Sufficient due diligence was not conducted.

We first bought shares of $NVDA for in January 2017 and added more in November 2018. After selling 29 shares in June 2023 and stock splits in 2021 and 2024, we maintain $NVDA in our portfolio at an effective cost basis of $5.28 per share. In August 2016, we bought shares of Shopify ($SHOP) for effectively $2.68 per share and today that position is roughly worth three percent of our portfolio. Berkshire Hathaway ($BRK) was, by far, the largest investment in our portfolio. Though our unrealized returns in $SHOP and $NVDA have been 21x and 11x, respectively, the unrealized return we maintain in $BRK, it’s returned roughly 14.6% per year and enabled us to attend the 2022 $BRK shareholders’ meeting.

Despite the unfortunate trades in $KNKT and $META, and trimming $NVDA before it appreciated another 324% between June 2023 and September 2025, despite withdrawals, our portfolio returned 15.4% per year since May 2016 while the Vanguard Total Market Index Fund (VTSMX**) has returned 14.76% per year since September 2015***. A ten-year U.S. Treasury Bond**** yielded 1.85% per year in May 2016; had our portfolio earned an annual return equal to the May 2016 ten-year Treasury yield, it would only be worth 21% of the value the actual value we hold today.

Combined, $NVDA, $SHOP, and $BRK are roughly thirty percent of our portfolio and account for a much larger share of our total returns. The opportunity cost of selling $META hurts, but is much less significant compared to our successes in $NVDA, $SHOP, and $BRK.

Take risks. Buy stocks (or funds that hold stocks on your behalf). Not going to comment whether my buddy should or should not have married his first wife, but he has since been married a lovely woman; he has taken another shot at love and he’s very happily married; so proud of him. As Michael Jordan is often quoted to say, you miss 100% of the shots you don’t take; after all missing, or forgoing, the opportunity to shoot results in as many points as a shot taken but missed. Jordan claims to have missed more potential-game-winning shots than anyone in NBA history; but he’s been ready to shoot when the opportunity presents itself, and that has made all the difference.

**$VTSMX may not be an appropriate benchmark compared to the holdings in our portfolio, but it is the passive fund I held before my investment style became more active.

***Morninstar reported the ten-year return for $VTSMX and for the purpose of this post, the ten-year return vs the 9.3-year return is sufficiently similar.

****The ten-year U.S. Treasury Bond yield is here used as a proxy for a risk free rate of return.